estate tax changes build back better

The BBBA proposal seeks to reduce these. Surtax of 5 on the modified adjusted gross income of a trust or estate above 200000 Additional 3 surtax on the modified adjusted gross income of a trust or estate.

Tpw Trending Today Archives Page 3 Of 9 Towerpoint Wealth

The Effects of the Build Back Better Act on Estate Planning.

. Compare 2022s Best Tax Relief Companies to Help You Get Out of Taxes. Prior versions of the Build Back Better Act didnt contain a modification to the 10000 cap but the Nov. President Bidens proposed Build Back Better Act includes major changes to estate and gift taxes to fund the social and education spending plan.

Ad We Provide Helpful Honest Information To Match You With Companies That Best Suits You. By Taylor Lihn PLLC. Tax Changes for Estates and Trusts in the Build Back Better Act BBBA The Build Back Better Act BBBA.

Gift and Estate Taxes Proposed Under the Build Back Better Act Lowering the gift and estate tax exemptions seems a lock. To help raise revenue to pay for President Bidens Build Back Better Plan Congress is considering a number of tax law. The prior version of the Build Back Better bill made substantial and far-reaching changes to the taxation of grantor trusts and transactions between the grantor and the trust.

Day Pitney Co-author s Stephen Ziobrowski Tasha K. Earlier this fall we sent out an advisory regarding the estate tax planning implications of the proposed Build Back Better Act the Act which had been. 3 version introduced an increase to the cap with a slightly higher.

Two recent pieces of legislation the Infrastructure Investment and Jobs Act IIJA and the Build Back Better BBB bill were expected to include provisions changing the. One major change proposed by the legislation would be to reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for. The estate planning community got some very good news on October 28 2021.

Build Back Better Act and Estate Planning Changes. Will Contests Breach of Fiduciary Duty Fraud Beneficiary Rights Right of Election etc. These proposals are currently under.

Call for a free case evaluation. Heres what you need to know. As initially proposed the Act would have reduced the current 117 million basic exclusion amount BEA to approximately 6 million on January 1 2022.

Ad Browse Discover Thousands of Book Titles for Less. 5376 would revise the estate and gift tax and treatment of trusts. The House Ways and Means Committee recently released its plan to pay for President Bidens proposed Build.

Ad Experienced Estate Trust and Probate litigation Attorney. November 5 2021. The House Ways and Means Committee approved President Bidens.

Proposed Federal Tax Law Changes Affecting Estate Planning. December 3 2021. President Bidens Build Back Better Act BBBA has made a significant first step towards passage as.

November 5 2021 in Uncategorized by Karen Dzierzynski. Three versions of the Build Back Better Act have attempted to make significant changes to current gift estate and trust income tax law. Estate and gift tax changes The Ways and Means version of the BBBA included many significant changes for both estate and gift taxes and the tax treatment of trusts.

House Bill Proposes Changes For Estate Planning Under The Build Back Better Act Senate Yet To Act Varnum Llp

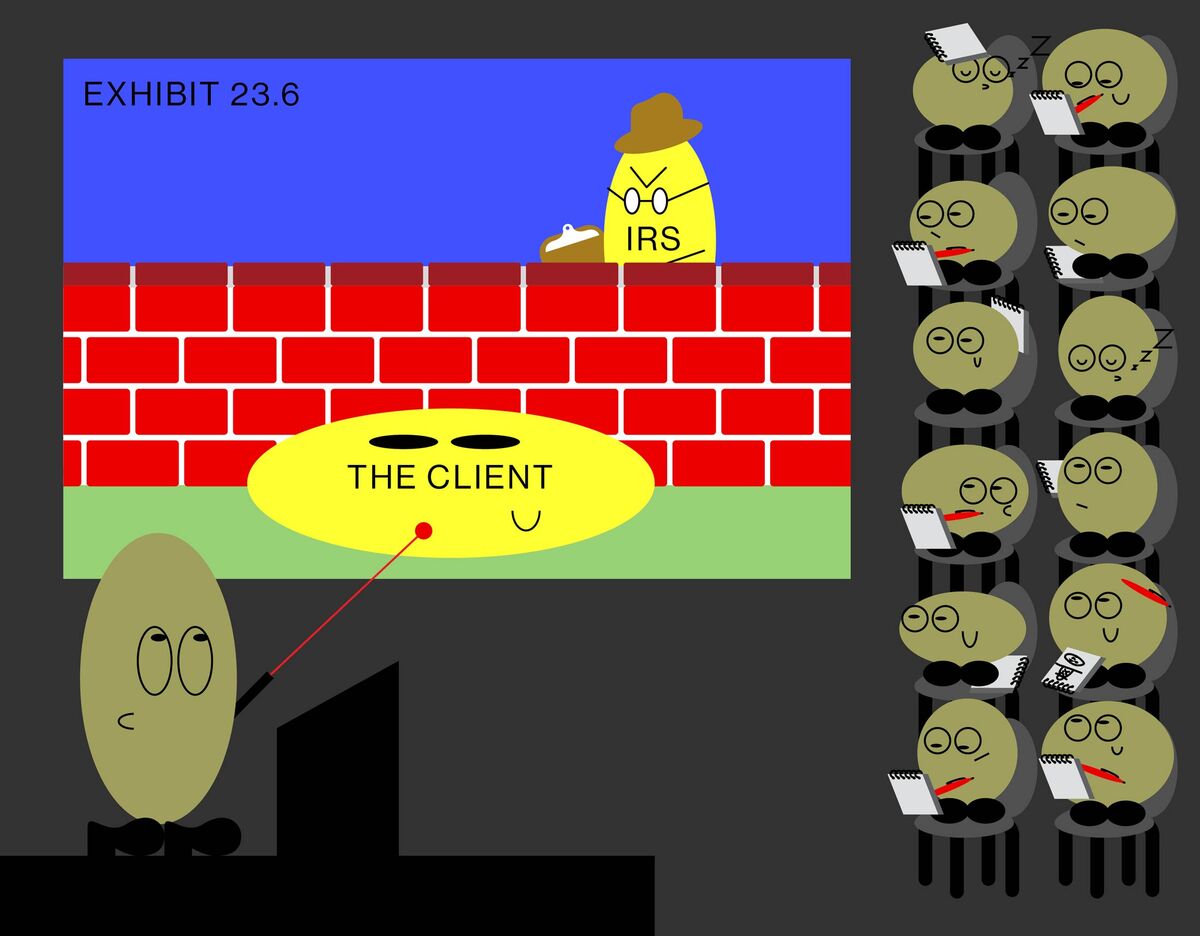

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

Build Back Better Act Proposed Estate And Gift Tax Changes Our Insights Plante Moran

H R 5376 Build Back Better Act Budget And Macroeconomic Effects Penn Wharton Budget Model

Individual Capital Gains And Dividends Taxes Tax Foundation

Estate Planner S Guide To The Latest Version Of Build Back Better Wealth Management

Build Back Better Thin Margin In Congress Foreshadows Change Negotiation Advisor Magazine

Will 2022 Bring New Tax Law Center For Agricultural Law And Taxation

Build Back Better Act S Potential Impact To Your Estate Plans Larson Brown P A

Gift Tax Archives Milliken Perkins Brunelle

Tax Implications Of House Passage Of The Build Back Better Act Chambliss Bahner Stophel P C Jdsupra

Estate Tax Advisers Help Clients Pass On Generational Wealth Bloomberg

House Passes Biden S Build Back Better Bill The New York Times

What Happens When You Don T Have Enough Assets To Pay Creditors In Full Can You Lose Personal Assets Find Out In Dan Staeven S Newest Let S Talk Bankruptcy Episode Where He Discusses Whether

:max_bytes(150000):strip_icc()/GettyImages-911586914-d4186dafdd8d4c3f94d4b0077f3c5918.jpg)

Explaining The Trump Tax Reform Plan

Estate Planning Changes Under The Build Back Better Act Estate Planning

The American Families Plan Taxes Billionaires And Protects Family Farms And Businesses Center For American Progress